In many developing countries, where most business transactions have historically been conducted with cash, mobile payment systems like M-Pesa have rapidly transformed the way goods and services are bought and sold.

Instead of carrying cash everywhere, you can now pay with your mobile phone – and unlike Google Wallet or Apple Pay, you don’t even need a smartphone. To complete a transaction, you simply use your phone’s keypad to enter the business’ phone number or ID, the amount of money to send, and your PIN.

When a transaction is completed, the mobile network sends a SMS receipt to both the sender (buyer) and recipient (seller). If you’re the seller, you can see the SMS receipt and know that you’ve been paid.

This payment flow works for in-person payments – but what about businesses that operate online? Developer APIs provided by services like Stripe and PayPal make it easy for online services to accept payments via credit cards and bank accounts, but not via mobile money systems. Some mobile money systems may offer their own APIs, while others don’t have developer APIs at all, or have APIs that are only available for large businesses.

If you want to accept mobile payments and there’s no API available, don’t give up – just scrape the SMS receipts! There are just three easy steps:

- Forward SMS receipts from your phone to your server

- Extract the relevant data from the SMS receipt

- Match the payment with the correct user and credit their account

At Telerivet, we’ve been using this method to accept payments from Tanzania via M-Pesa and Tigo Pesa for over a year already – allowing us to receive millions of shillings in revenue from customers who would have been unable to pay via credit cards or PayPal.

If you want to accept mobile money payments in your own online service, read on to learn how to do it:

1. Forward SMS receipts from your phone to your server

When anyone sends you a mobile money payment, the mobile network will send your phone a SMS receipt. Your online service needs this receipt to know that someone has paid you.

To forward SMS receipts from your phone to your server, you can use the Telerivet Android app together with the Telerivet Webhook API.

If you don’t have an Android phone already, get an Android phone and install the SIM card associated with your mobile money account. Then install the Telerivet Android app on your phone. Finally, configure the Webhook API to forward incoming SMS messages to a URL on your server.

Of course, this method requires your business to have a presence in the country where you’re accepting payments – it doesn’t help accept or transmit mobile payments internationally, since your business still needs to register for a mobile money account, and the funds stay in the mobile money account until you withdraw them.

2. Extract the relevant data from the SMS receipt

Each mobile money system uses a different format for their SMS receipts.

Here’s an anonymized example receipt (in Swahili) from Tigo Pesa in Tanzania:

Tigopesa: Salio jipya ni Tsh 67,676. Umepokea Tsh 16,000 kutoka kwa JOHN SMITH, 0730000000. 06/10/2014 11:59 AM, kumbukumbu no. PP141006.1159.B00001. Tigo Pesa inakulipa mteja wake faida kulingana na wastani wa salio lako la kila siku. Faida nyingine italipwa mwezi wa 10, 2014. Pata zaidi na Tigo Pesa TU.

It contains several pieces of data:

Current Balance: Tsh 67,676

Amount Received: Tsh 16,000

Payee Name: John Smith

Payee Phone Number: 0730000000

Transaction Time: 6 October 2014, 11:59 AM (East Africa Time)

Transaction ID: PP141006.1159.B00001

In order for your online service to process a user’s payment, the most important information is the amount received and the transaction ID.

Extracting this information will likely involve writing regular expressions to match the particular format of SMS receipts generated by the mobile money service. This can get a little tricky.

In the case of receiving funds via Tigo Pesa, we first make sure to only consider SMS messages from the sender ID “Tigopesa”.

(You may want to test if your mobile network allows other people to send spoofed SMS messages with the same the sender ID as their mobile money system. If so, you could prevent spoofed SMS receipts by keeping track of your current balance, and verifying that the balance in the SMS receipt is correct.)

To extract the amount received, we can use this regular expression:

UmepokeaW+TshW*([d,.]*d)

Note: You may also want to take special care to avoid letting someone falsify their payment amount by changing their registered name to “Umepokea Tsh 1,000,000”.

To extract the transaction ID, we can use this regular expression:

kumbukumbu noW+(w{8}.d{4}.w{5,}b)

While SMS receipt formats are typically relatively stable, mobile money systems sometimes change the format or wording of the receipts.

At this point, your service still doesn’t know which user account should be credited for the payment. (You might be able to figure it out from the payee name and phone number, but that’s unreliable.)

Instead, just store the transaction ID and payment amount in your database, so that it’s available in the next step.

3. Match the payment with the correct user and credit their account

Finally, you need to match the receipt with the correct user of your online service, so you can credit the correct account.

Some mobile money systems, including Tigo Pesa, have systems for businesses that allow customers to enter a reference number for their account when sending a bill payment. But this type of bill payment system is sometimes only available to large businesses. When someone sends money to your phone number, they probably won’t be able to send a reference number.

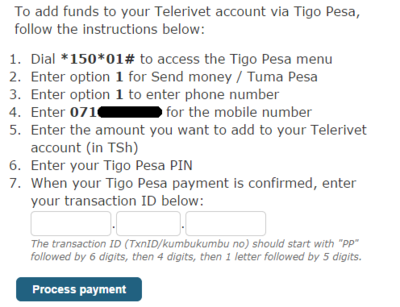

In this case, you can simply prompt the user to enter the transaction ID in your application, like in the example below:

The customer knows this transaction ID because the mobile money system sent the customer their own SMS receipt containing the same transaction ID:

Tigopesa: Salio jipya ni Tsh 118,006. Hamisho la fedha kwenda kwa EXAMPLE INC limekamilika; 0731110000; Kiasi Tsh. 16,000; Ada Tsh. 350;kumbukumbu no. PP141006.1159.B00001. Tigo Pesa inakulipa mteja wake faida kulingana na wastani wa salio lako la kila siku. Faida nyingine italipwa mwezi wa 10, 2014. Pata zaidi na Tigo Pesa TU.

When the customer enters a transaction ID in your application, your application can check your database for that transaction ID. If it matches, then credit the user with the payment amount associated with that transaction ID. (Be sure to prevent people from reusing the same transaction ID multiple times.)

If the customer enters a transaction ID that doesn’t match your database, it could be because you haven’t received the SMS receipt yet, or because the customer made a typo (often it can be hard to tell the difference between the digit zero and the letter O, or the letters I and L and the digit 1).

In this case, we suggest storing the transaction ID entered by the customer in your database and notifying someone on your team to look into the transaction. If there was a typo, you can record the payment manually; if the receipt was delayed, your system can process the payment manually whenever the receipt is received.

Scraping data from SMS receipts may not be the cleanest solution for accepting mobile money payments, but sometimes it’s the only solution.

Fortunately, at least one mobile money system soon plans to make this easier: Safaricom M-PESA in Kenya currently plans to open their developer API in April 2015 . But there’s no need to wait for someone else to release an API — just start scraping SMS receipts and letting your customers pay you today.